Published on: July 31, 2023

Learn how cloud-native technology can revolutionize your banking operations.

In today's ever-changing financial landscape, small and medium-sized (SME) lending companies face numerous challenges in streamlining operations and driving business growth. Confronted with varying loan application volumes throughout the year, some lenders find their on-premises infrastructure struggling to handle surges, resulting in slow response times and frustrated customers. To conquer these obstacles and achieve substantial growth, lenders are increasingly turning to cloud-native core banking solutions—a modern and transformative approach providing the scalability and flexibility required to meet the unique needs of SMEs.

In this blog, we will explore how cloud-native software empowers SMEs to overcome challenges, embrace agility, and pave the way for sustainable growth and market expansion.

Cloud technology is a cutting-edge concept that allows businesses to access and manage their data and applications over the internet instead of relying on physical servers and equipment. This virtual infrastructure, maintained by cloud providers, offers numerous benefits, including automatic scalability, efficient resource allocation, and robust security measures.

Cloud-native core banking solutions revolutionize SME lenders' operations by embracing the "Pay-as-You-Grow" paradigm. Through the power of cloud technology, these lenders can efficiently handle fluctuations in demand, ensure high availability, and optimize resource utilization. The flexibility of cloud-native platforms allows them to seamlessly scale their operations up or down according to business volumes, whether it's expanding into new markets or diversifying product portfolios.

To achieve this level of flexibility, technology providers develop software on cloud platforms that provide an elastic infrastructure. This means that the system can automatically adjust itself based on how much demand it has. If more people are using the system, it can automatically make itself bigger to handle the load. And when the demand decreases, it can shrink back down to save resources. The cloud provider takes care of managing all of this, making sure the system has what it needs when it needs it. This way, the system can handle different amounts of work without needing someone to change it manually. It is like the system knows how to adapt on its own to keep things running smoothly.

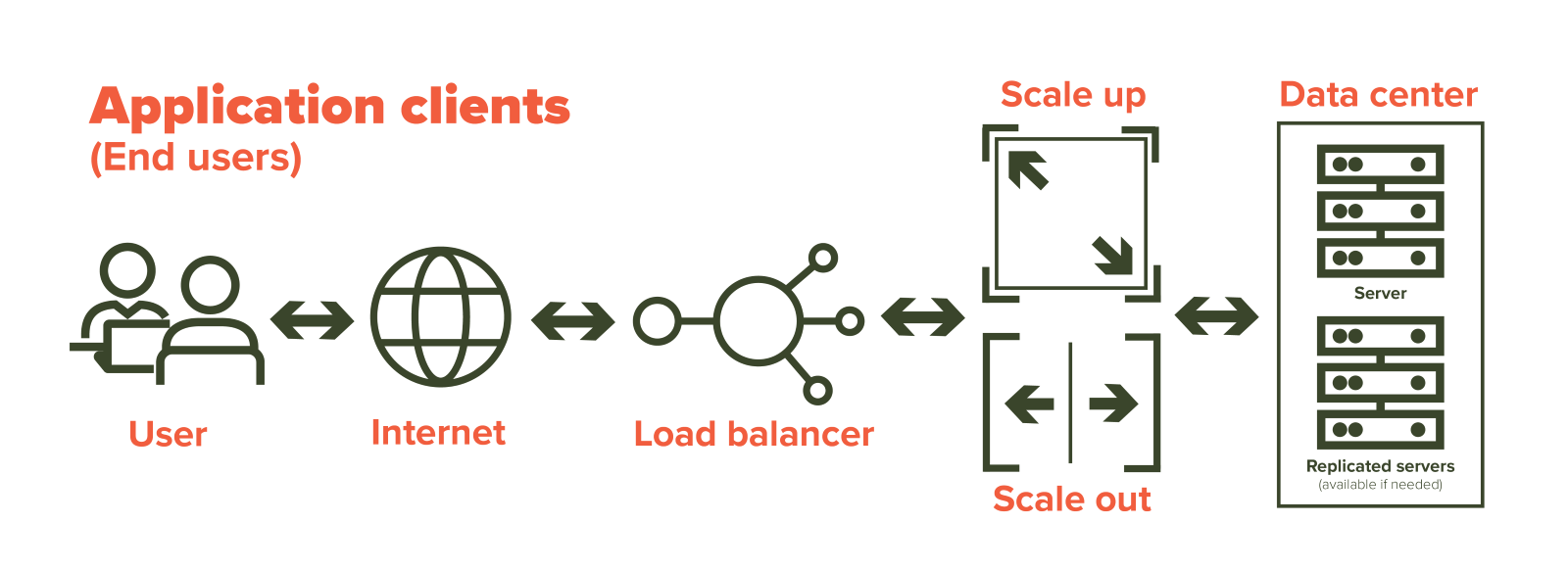

Load-balancing in cloud-native core banking ensures that the system works smoothly even during busy times. It spreads out the workload across multiple parts of the system, so no single part gets overloaded. For example, when many people apply for loans at once, load balancing makes sure the system can handle it without slowing down or crashing. It also adds a backup plan, so if one part of the system has a problem, it switches to another part, making sure the service keeps running without interruptions. This way, cloud-native systems can handle varying amounts of work and provide a seamless experience for customers, no matter how busy things get.

Cloud-native platforms come with monitoring and auto-scaling features that keep a close watch on how the system is doing. It pays attention to important things like how much processing power is being used (CPU utilization), how much memory is being used, how much data is being sent over the network, and how quickly the system responds to requests. Based on preset rules and limits, the system automatically makes changes to resources. For example, if the system sees that it's using too much processing power (CPU), it will add more resources to handle the extra work. On the other hand, if the workload decreases, it will remove any extra resources to save costs.

In simple terms, the platform takes care of adjusting things behind the scenes to make sure everything runs smoothly. It's like having a smart system that knows when to add or remove resources, so SME lenders can handle different workloads without needing to do it themselves. This way, the system is always ready to handle whatever comes its way, keeping things running efficiently and cost-effective for SME lenders.

To make automatic scalability possible, core banking suppliers can utilize services provided by cloud providers like AWS, Google Cloud, or Azure. These services come with built-in capabilities for automatic scalability, enabling SME lenders to focus on their main business activities while the cloud provider takes care of all the technical aspects related to scaling resources. This way, the system can seamlessly adjust itself to handle varying workloads, ensuring a reliable and efficient experience for lenders and their customers.

One critical aspect of cloud-native platforms is their robust security measures. Cloud providers invest heavily in state-of-the-art security protocols and compliance standards to protect sensitive financial data. These platforms typically offer features like data encryption, multi-factor authentication, and continuous monitoring to safeguard against potential cyber threats. SME lenders can rest assured that their customers' sensitive financial information is well-protected within the cloud environment.

Cloud-native platforms ensure cost efficiency for SME lenders by enabling them to pay only for the resources they use when needed, avoiding wasteful spending on extra capacity. Unlike traditional systems that require buying and managing physical equipment on the company's premises, cloud-native platforms eliminate the need for all that. This reduces upfront investments and ongoing maintenance costs for SME lenders. Instead, the cloud provider takes care of hardware, security, and upgrades, freeing up resources and budgets for lenders to focus on their core business and innovation.

In the digital transformation era, cloud-native core banking solutions emerge as catalysts for accelerating SME lender growth. By embracing the agility and scalability offered by cloud-native technology, SME lenders can confidently pave the way for sustainable growth and market expansion. The cloud-native approach allows them to focus on their core business while leaving the technical complexities to the cloud provider, ultimately driving success in the ever-evolving financial landscape.

Cloud-native core banking solutions present a game-changing opportunity for SME lenders to thrive in today's dynamic financial landscape. By leveraging automatic scalability, load-balancing techniques, robust security features, and cost efficiency, SME lenders can streamline operations, enhance customer experience, and achieve sustainable growth. As they embrace cloud-native technology and collaborate with reputable cloud providers, SME lenders can confidently navigate the challenges and seize the opportunities that lie ahead.