As the shift of digitalization has taken place, it has become critical for lenders to evolve and improve their loan processes. The end customer has an increasing demand for an efficient and streamlined lending process, from the way the loan originates through the entire lending process.

For instance, to allow for a seamless lending process 61% of loan statements are already delivered online. To keep up with these increasing customer demands and stricter regulatory requirements, it has become essential that lenders implement innovative lending solutions.

The growth has been exceptional in recent years, with projections of the Loantech market capacity reaching 22.4 billion dollars by 2028. This comprehensive solution aims to provide lenders with peace of mind by ensuring that loans are managed effectively and that the lender is paid back in full according to the agreed terms.

Loan management software helps to simplify the loan process, reducing the time and effort required to manage loans and increasing efficiency. This includes tasks such as loan origination, servicing, and collections. As a result, financial institutions can serve their clients efficiently while also reducing the risk of loan defaults. The software is implemented in a variety of financial institutions such as banks, credit unions, and specialized loan service providers. These institutions are often replacing their older loan management systems due to the limitations of scalability and configurability, making innovative loan management software a more attractive option.

%20(941%20%C3%97%20700%20px)%20(1).png?width=740&height=550&name=Loan%20origination%20(941%20%C3%97%20500%20px)%20(941%20%C3%97%20700%20px)%20(1).png)

%20(941%20%C3%97%20700%20px)%20(6643%20%C3%97%202654%20px)%20(941%20%C3%97%20400%20px).png?width=941&height=400&name=Loan%20origination%20(941%20%C3%97%20500%20px)%20(941%20%C3%97%20700%20px)%20(6643%20%C3%97%202654%20px)%20(941%20%C3%97%20400%20px).png)

Modern loan management software can be a crucial aspect of lending that can enhance the overall experience for both lenders and borrowers. Many businesses face challenges in managing their loans effectively due to outdated legacy systems. These systems often lack scalability, hindering the business's growth potential in terms of loan capacity. This is where a modern banking solution can prove its value.

The lending process involves multiple complex steps, from the initial onboarding to the final closing stage. Any errors made during the process can result in significant problems, including incorrect company or individual assessments, misreporting, and incorrect calculations. With increasing regulatory requirements, it is imperative to maintain precision in all aspects of the lending process. One way to achieve this is by digitizing and modernizing the process. The leading benefits are identified.

Loan servicing software is completely built to rule out mistakes. Calculations are complex, and the new algorithms are simply more reliable than humans or older legacy systems. Many companies are using self-build or re-build software solutions such as excel sheets, these systems are missing essential automation. The lack of atomization creates a big gap of work open for mistakes.

Loan servicing systems incorporate analytical modules that provide real-time and precise data of the lender to quickly determine the Probability of Default (PD). Using the PD rate, applications can be rejected or accepted automatically.

The software can produce reports that include valuable data. Naturally, companies who seek to enhance their legacy systems might face difficulties with their closed systems, as these types of solutions make it challenging for users to obtain information.

Producing reports plays a crucial role in meeting regulatory requirements and provides valuable information to the management team, thus facilitating more rapid decision-making. Additionally, automated reporting can streamline employee workflow. For instance, the system can create a call-to-action list for employees to follow up on overdue payments.

The highly automated process enables a business to handle a higher volume of loan applications, resulting in more efficiency and reduced operational costs. It frees employees to maintain strong client relationships and pursue new business opportunities. Additionally, using a standardized system enables lenders to customize their system, without requiring extensive development work. This not only saves time and resources, but also reduces the reliance on developer employees.

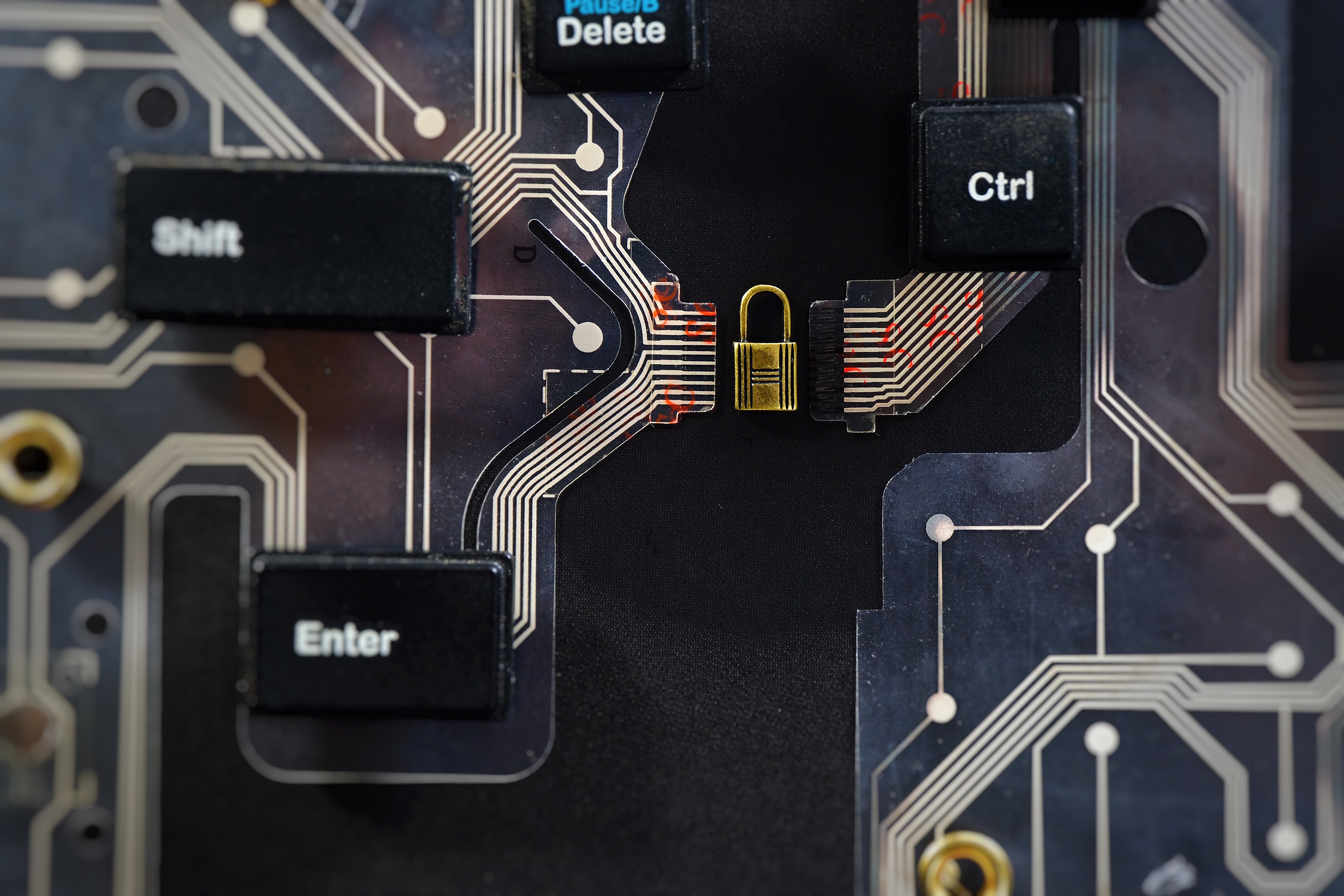

The lending market is changing, and the standards set for loan products are becoming increasingly demanding. By incorporating SaaS systems into lending operations, businesses can stay ahead of the curve and remain flexible in response to market demands. This technology provides several key benefits, including quick loan application processing, increased flexibility, scalability, heightened security, and compliance with regulations.

The loan technology market is poised for continued growth driven by the increasing demand for cutting-edge technology and the need for financial institutions to stay ahead of the competition.

Download the product paper and discover more.