Published on: April 13, 2023

Learn about the future of financial services and how to adapt to digital transformation.

Digital-native disruptors and market demands are transforming the financial landscape. With the rise of FinTech competitors and stringent regulatory requirements, financial institutions face enormous pressure to innovate quickly in order to remain relevant and compliant.

To overcome these limitations, financial service providers must embrace digital transformation and adopt technological innovations. They must recognize the need to modernize their technology infrastructure, by migrating from monolithic systems to modern cloud-native architectures to unlock a plethora of benefits.

Embracing next-gen technologies and agile solutions can provide the necessary flexibility and scalability required to meet evolving market demands and regulatory compliance. Let's explore this topic in depth in the following sections.

A topic that has gained meaningful traction in recent years in the financial industry is core banking transformation. This process involves replacing outdated legacy banking systems with modern, flexible, and modular platforms capable of supporting end-to-end operations. Learn more about core banking transformation here.

Traditionally, banks have relied on inflexible monolithic systems that are challenging to upgrade and lack adaptability in a rapidly evolving market. Such outdated systems impede innovation, customer-centricity, and lead to operational inefficiencies and high maintenance costs. In recent years we are witnessing game-changing technologies that have significantly impacted the financial industry.

The term "core" refers to a centralized system that establishes the essential infrastructure for offering a comprehensive array of services. Traditionally, these systems were built using on-premises technology. This meant that physical servers and software installed and maintained on-site by the bank's IT department. Learn more about core banking here.

Today, the evolution of modern systems delivered better functionality but still a rigid monolithic infrastructure, inhibiting banks from reducing their costs and accelerating their time to market. The development of cloud-native systems and API-functionality integration give core banking the opportunity to ‘step functionalities up’. Learn more about core banking evolution here

Now with next-gen cores, financial institutions can keep up with the pressing demand for digitalization of all systems. New solutions have quickly proved to be the future for many day-to-day processes—all with the added value of lower costs.

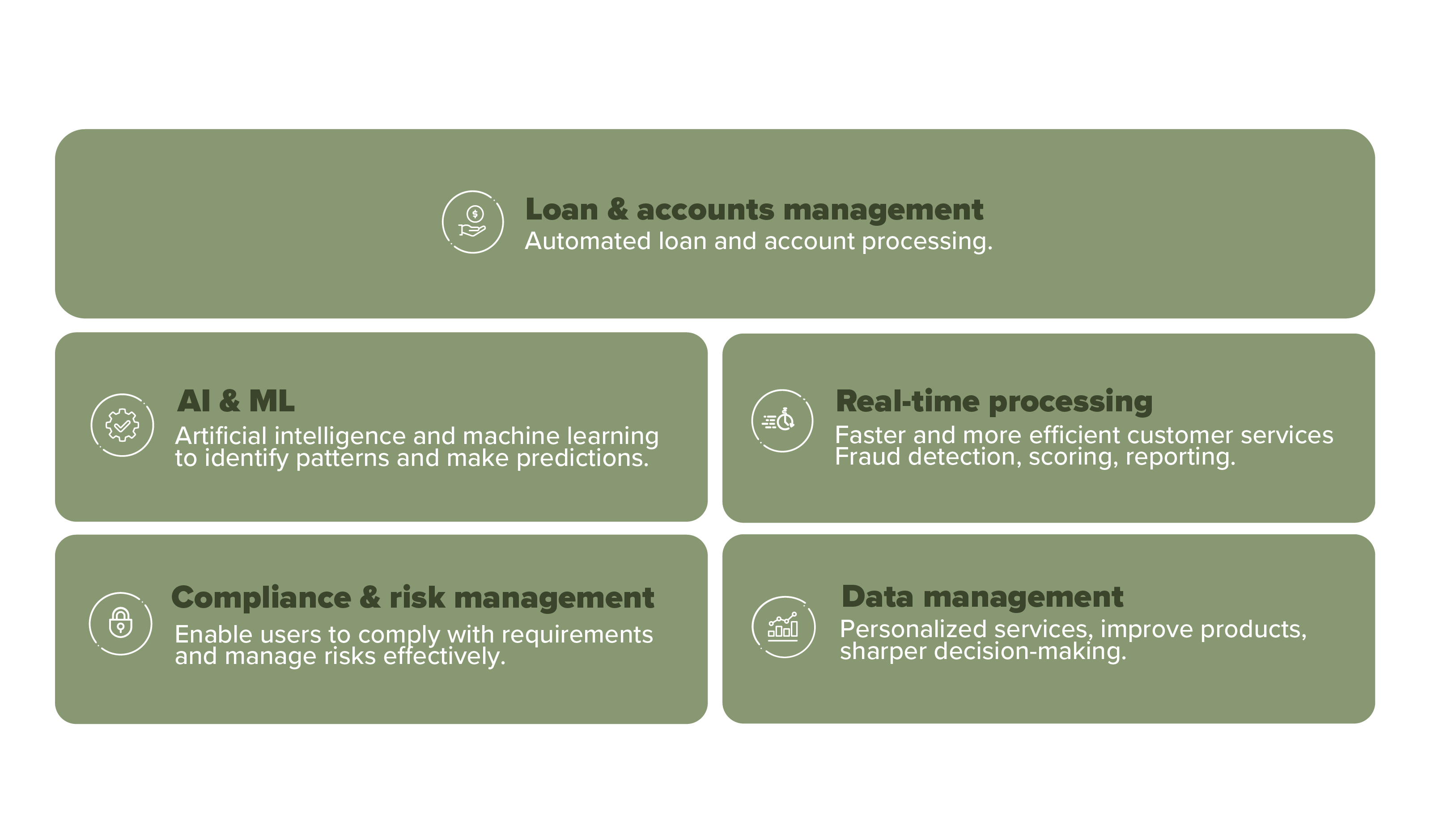

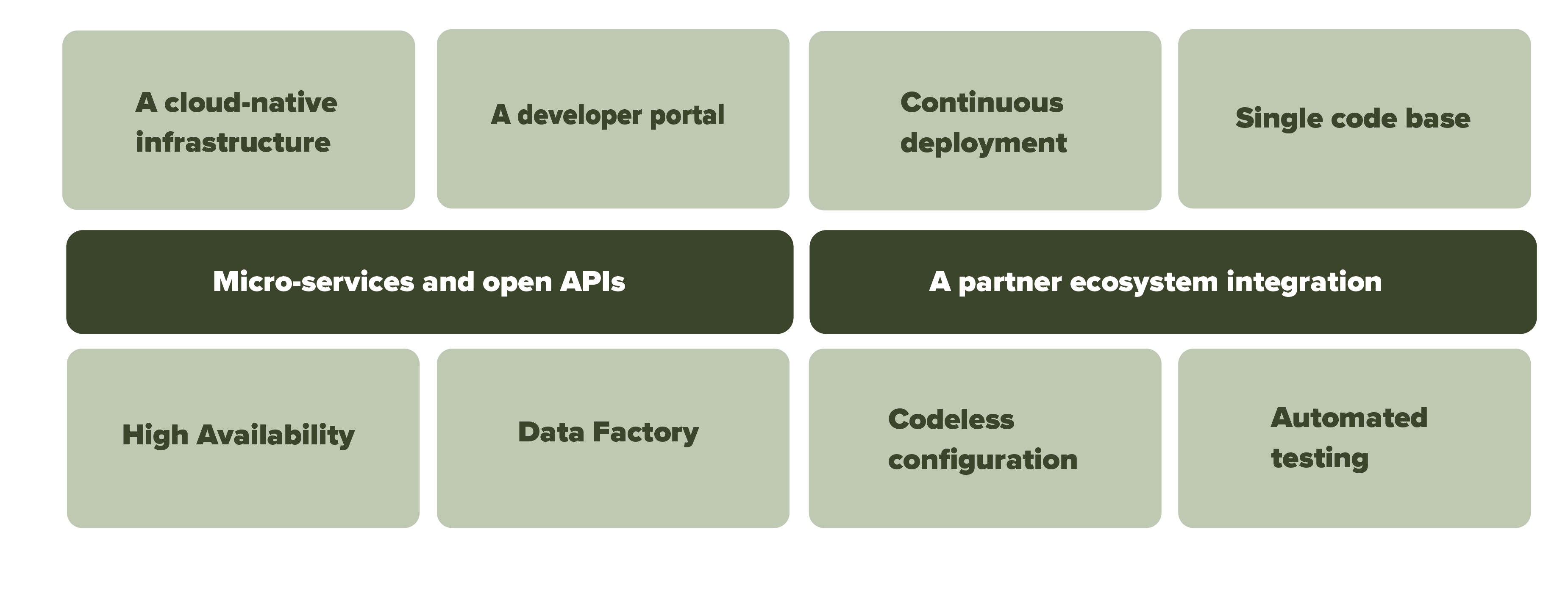

Next-gen cores are the platforms that keep financial service providers' needs and ambitions in mind. These cores are cloud-native financial processing systems with a cutting-edge, flexible, scalable, and composable architecture. They allow their adopters to leverage modern technologies to make banking processes smooth and automated.

With improved scalability, agility and security, operations executed on digital-native systems are quickly proving to be the future for many day-to-day processes. All of that, with the added value of much lower costs.

In the current market, we see new tech-savvy players (I.e., FinTech’s, neo banks, and non-financial institutions), and some banks addressing ongoing market demands through adopting next-gen solution. SME Lenders are also early adopter of these new offers. These players are seeing their potential and leveraging their benefits.

Financial institutions that initially feared the impact of new-age technology have started seeing its potential, due to the constraints of their core architectures and their slow pace of modernization. Therefore, the logical next step is to adopt a modern cloud-native one, that will enable them to innovate faster and operate more efficiently while decreasing IT service costs.

To learn more about data management in core banking, and data compliance by clicking the links.

To learn more about the key benefits of adapting a Next-Gen Core Banking system, download our in-depth guide by submitting the form on this blog.

The field of core banking transformation is constantly evolving, and several trends and technologies are likely to shape the next phase. Regardless of future possibilities, we know now that the most obvious step is adopting technologies that will empower businesses to embrace future ambitions. It is crucial for financial institutions to stay up to date on the latest developments and to maintain an innovative and open mindset to adopt and adapt to them.

We understand how digital disruptors are pushing away outdated, legacy systems. Therefore, we created our cutting-edge cloud-native core banking software, °neo, to enhance your financial institution's growth and success.

Say goodbye to traditional on-premise systems and hello to a future-proof solution that adapts seamlessly to your evolving needs. With our next-gen core banking solution, you'll experience the power of true cloud-native technology combined with the flexibility and scalability of a modern SaaS platform.

Interested in more information on the future of digitalization, how to keep up with it? Discover here how our cloud-native core banking system enables financial services to be future-proof.

References