Published on: June 28, 2023

Digital transformation is undoubtedly essential for banks to stay competitive and meet customers' evolving needs. It increases efficiency, agility, and value creation. However, it is crucial to remember that the human touch is one of the must essential elements when going through this shift.

On the 27th of June I had the chance to share personal experiences with fintech lovers attending an event at five°degrees' headquarters. The human touch in core banking transformation is something I have witnessed firsthand throughout my career in the banking industry. As an expert in innovation for banks, I have seen numerous challenges and successes when implementing digital transformation projects. One challenge that stands out is the need to maintain the human element amidst the wave of technological advancements.

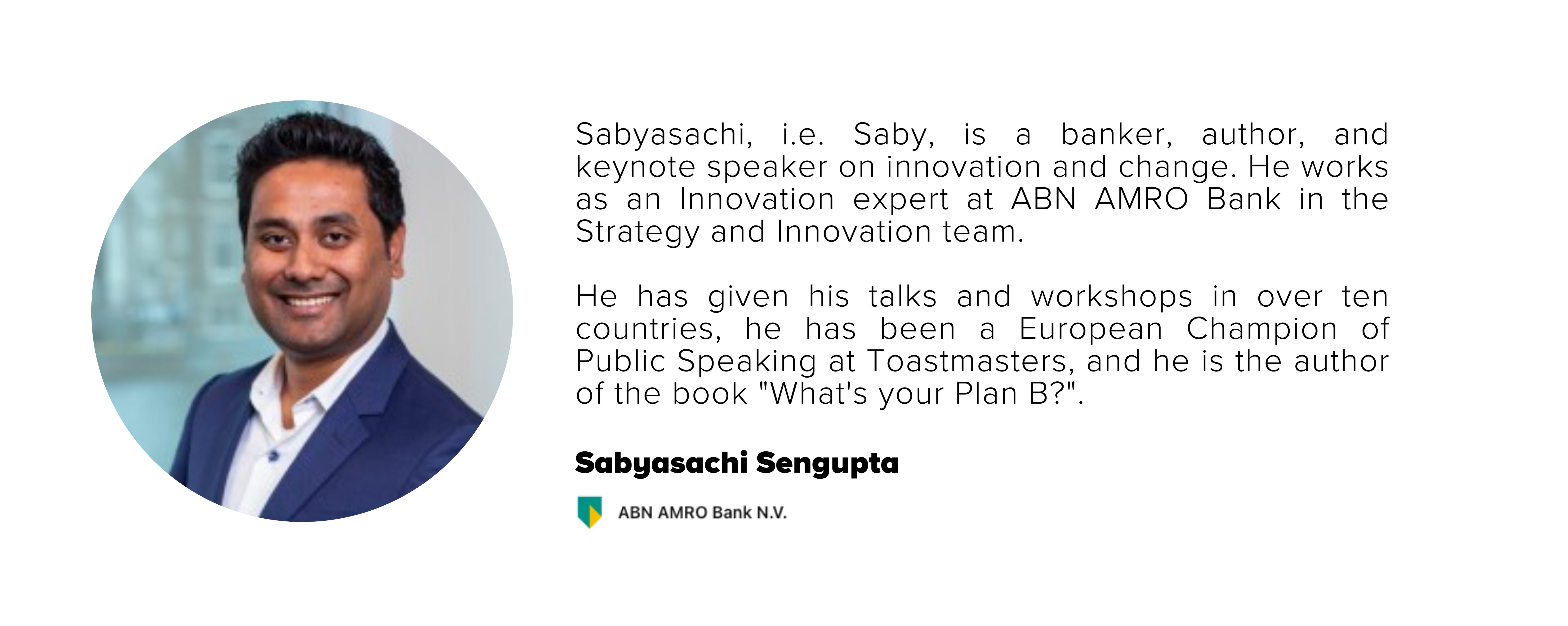

''It is crucial to remember that the human touch is one of the must essential elements when it comes to digital transformation''. Sabyasachi Sengupta.

In my experience, the 'influence model' is one of the most effective practices during core banking transformations. This model revolves around shaping the mindset and behavior of individuals within the organization. It requires shifting from traditional thinking towards a more collaborative and experimental approach. At the event I share the must critical elements that must be consider when onboarding on core a banking transformation project. Here my recommendations:

1. Communication and engagement play a critical role in the success of the influence model. Clear and transparent communication about the transformation objectives, progress, and challenges is vital to ensure that everyone understands the purpose and impact of the changes. In this scenario, for example, as a company, you must always address three vital questions: What, Why and How?. These questions mean you understand why you must embark on a digital transformation. How will this entire journey be made, and what means is required to tackle all the challenges successfully?

2. Collaboration is another critical aspect of the influence model. By encouraging cross-functional teams and fostering a collaborative culture, banks can tap into their employees' collective knowledge and expertise. This accelerates the transformation process and instills a sense of ownership and accountability among the workforces.

3. Empowering employees is equally important. Investing in their development and providing the necessary training and resources helps them adapt to the digital era. By upskilling and reskilling employees, banks can equip them with the knowledge and confidence to embrace new technologies and deliver exceptional change.

While technology is undoubtedly a driver of change, the human touch should not be overshadowed. The influence model, emphasizing communication, collaboration, and empowerment, provides a framework for banks to navigate the complexities of transformation while preserving the human element. Banks and core banking providers alike, can prioritize the human touch to ensure a successful and customer-centric transformation journey.

Are you ready to transform your core banking system? Lear more about °neo, the next-gen core banking platform that will enable your business to meet the industry needs and remain competitive in a digital landscape.

About.