Built to compose. Engineered to scale.

Secure. Compliant. In control.

Banking is transforming. Fast. Digital-natives are continuously raising the bar. Customers expect more. Regulations demand agility. You need a connected, ever evolving platform to keep pace.

Topicus unveils Akkuro - The next-generation composable banking platformStrong relationships built strong businesses

That’s where Akkuro comes in

Akkuro, by Topicus is a pioneering software company with over 25 years of experience in banking and finance innovation. Trusted by global organizations, we empower banks and financial institutions to adapt, scale and lead, without disruption or compromise.

Our composable, cloud-native platform is built for agility. API-first and compliant by design, it gives you the flexibility to evolve on your terms: no vendor lock-in, no legacy roadblocks, no unnecessary complexity. Just powerful, customizable banking. Built for speed and resilience.

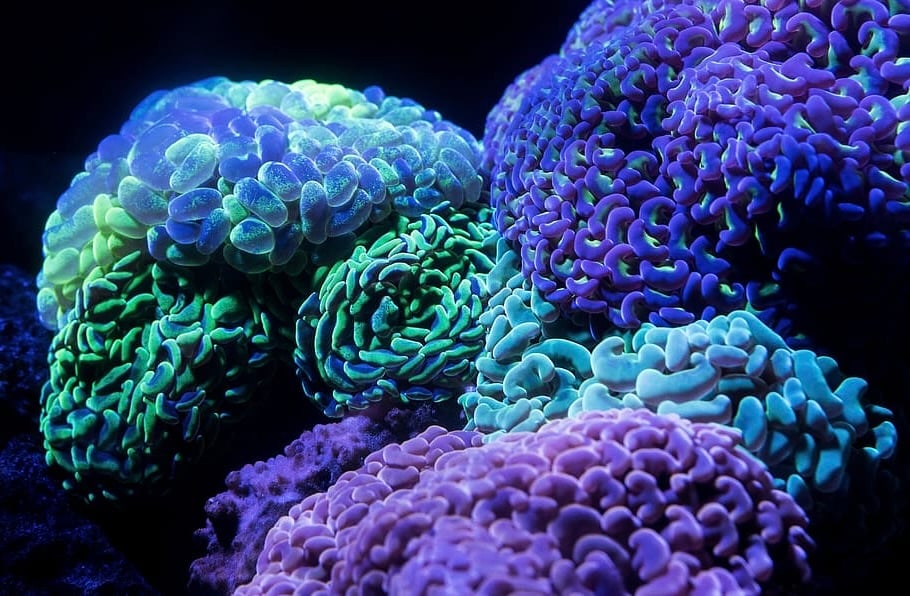

Imagine building a brain for banks

One continuously learning, adapting and evolving banking system. It's here. It's live.

Explore Agentic BankingConnecting people, data and technology

$ Billion

in annual loan volume$ Billion

in deposits managed$ Billion+

in assets under managementAkkuro's Composable Banking Platform

At the core of Akkuro’s platform is a bold belief: agility is not optional, it’s a competitive necessity.

Akkuro offers modular, domain-specific building blocks that work together seamlessly through a unified orchestration layer; structuring data, connecting services and powering smarter, faster customer experiences. Our modular, cloud-native platform is built for agility. API-first and compliant by design, it gives you the flexibility to evolve on your terms: no vendor lock-in, no legacy roadblocks.

Explore composable bankingAkkuro’s SaaS lending platform simplifies end-to-end lending, boosting efficiency, customer satisfaction and innovation with seamless integration and a no-code architecture.

Explore LendingSimplify end-to-end lending, boosting efficiency, customer satisfaction and innovation with seamless integration and a no-code architecture.

Explore Digital LendingAutomate the entire loan process with real-time data integration, enabling informed decisions, faster approvals and scalability for institutions of any size.

Explore Loan OriginationElevate your lending setup with disbursements, payment collections and arrears management to reduce manual tasks, improve cash flow and maintain a healthier loan portfolio.

Explore Loan AdministrationEffortlessly handle client and loan agreement reviews, monitoring, restructuring and change requests ensuring flexible, compliant and proactive loan administration throughout the entire lifecycle.

Explore Loan ManagementAutomate the integration, validation and management of critical data -from financial reports to KYC documents - ensuring smooth, secure and efficient data flow across the entire lending process.

Explore Data Aggregation/Digital%20Lending/202503_lending_digital_lending_overviewnew.jpg?width=1600&height=1200&name=202503_lending_digital_lending_overviewnew.jpg)

/Loan%20Origination/Lending_LoanOrigination_1_ProductEngineForFlexibleLoanOffering.png?width=1440&height=1080&name=Lending_LoanOrigination_1_ProductEngineForFlexibleLoanOffering.png)

/Loan%20Administration/3_LoanAdministration.png?width=1440&height=1080&name=3_LoanAdministration.png)

/Loan%20Management/Lending_LoanManagement_Overview.png?width=1440&height=1080&name=Lending_LoanManagement_Overview.png)

/Data%20Aggregation/Lending_DataAggregation_Overview.png?width=1920&height=1440&name=Lending_DataAggregation_Overview.png)

Streamline the mortgage lifecycle with a unified workspace, automated compliance and real-time customer insights for seamless collaboration and transparency.

Explore MortgagesEmpower sustainable growth and client trust with flexible, compliant investment solutions tailored for every market segment. Our platform offers real-time trading, personalized portfolio management, tailored private banking solutions, tax-efficient investment strategies and seamless precious metal trading to meet diverse client needs and enhance financial growth.

Explore InvestmentsOur platform enables real-time services, seamless trading and regulatory compliance with speed and transparency.

Explore Global TradingEnhance portfolio management with automated workflows, a coherent strategy implementation and scalable investment models to drive client growth and efficiency.

Explore Portfolio ManagementUnlock potential by delivering real-time insights, personalized investment strategies and advice and customizable reporting for high-net-worth clients.

Explore Private BankingSmart, tax-efficient investment solutions with automated management, compliance and scalable investment models to drive client growth and efficiency, securing long-term retirement wealth, maximizing benefits, strengthening relationships and expanding client base.

Explore Fiscal InvestmentsTrade gold, silver and platinum with ease on our platform, diversifying your portfolio with stable, resilient assets that hedge against market volatility.

Explore Precious Metals/Global%20Trading/Global_Trading-Any_Asset_Class.png?width=2000&name=Global_Trading-Any_Asset_Class.png)

/Portfolio%20Management/Portfolio_Management-Define_Maintain_Model_portfolios.png?width=2000&name=Portfolio_Management-Define_Maintain_Model_portfolios.png)

/Private%20Banking/Private_Bankin-Performance_Valuation_Reporting.png?width=2000&name=Private_Bankin-Performance_Valuation_Reporting.png)

/Fiscal%20Investments/Fiscal_Investments-Portfolio_Management.png?width=2000&name=Fiscal_Investments-Portfolio_Management.png)

/Investments-Metals-ProductFeature@2x.png?width=1304&height=936&name=Investments-Metals-ProductFeature@2x.png)

Offer customizable term deposits, dynamic variable interest accounts and intuitive tools to streamline operations, boost profitability and enhance client experiences.

Explore SavingsOffer flexible, market-driven growth with variable interest accounts, featuring real-time rate adjustments, intuitive management, and built-in compliance tools.

Explore Variable Interest SavingsProvide smarter, customizable term deposit plans with fixed or tiered interest rates, automated transfers, and streamlined management for enhanced client engagement and compliance.

Explore Term DepositsMaximize fiscal savings through tax-efficient investment solutions with intuitive management, compliance and life cycle management to maximize benefits.

Explore Fiscal Savings/Savings-Variable-ProductFeature@2x.png?width=1304&height=960&name=Savings-Variable-ProductFeature@2x.png)

/Savings-Deposit-ProductFeature@2x.png?width=1304&height=960&name=Savings-Deposit-ProductFeature@2x.png)

/Savings-Fiscal-ProductFeature@2x.png?width=1304&height=936&name=Savings-Fiscal-ProductFeature@2x.png)

Our composable, customer-centric Core Banking empowers rapid innovation, scalability and seamless connectivity with a wide range of APIs. Designed for resilience and flexibility, it enables you to easily adapt, replace components and stay ahead-without vendor lock-in.

Explore Core BankingEmpowering banks to deliver seamless, scalable and customer-focused transactional banking via cards and cross-border payments.

Explore Current AccountsStreamline operations and simplify the use of multiple currencies with one multi-currency account managed through a single IBAN.

Explore Multi-Currency AccountsFrom simple FX transactions to a sophisticated forward agreement, companies can now have complete control over their FX contracts.

Explore Foreign Exchange/Core-Banking-CurrentAccount-ProductFeature@2x.png?width=1304&height=936&name=Core-Banking-CurrentAccount-ProductFeature@2x.png)

/Core-Banking-MultiCurrency-ProductFeature@2x.png?width=1304&height=936&name=Core-Banking-MultiCurrency-ProductFeature@2x.png)

/Core-Banking-ForeignExchange-ProductFeature@2x.png?width=1304&height=936&name=Core-Banking-ForeignExchange-ProductFeature@2x.png)

Say goodbye to costly, complex systems and hello to a smarter, scalable, and customer-first approach that unlocks speed, insight and innovation in financial services.

Explore CRM for BanksDesigned for seamless integration, Akkuro's calculation engines empower financial institutions to handle complex scenarios with accuracy and ease.

Explore Calculation EnginesCompliant financial calculations, empowering lenders to handle custom scenarios with ease.

Explore Lending CalculationsPremium calculations and risk assessments tailored to individual profiles.

Explore Insurance CalculationsMaximum mortgage calculations, repayment simulations and housing cost analysis.

Explore Mortgage CalculationsSustainability calculations and real-time insights for informed investment decisions.

Explore Sustainability Calculations/Lending/Lending_Calculation_Overview.png?width=1440&height=1080&name=Lending_Calculation_Overview.png)

/Akkuro.com%20-%20Insurance.png?width=2000&height=1500&name=Akkuro.com%20-%20Insurance.png)

/Akkuro.com%20-%20Mortgage.png?width=2000&height=1500&name=Akkuro.com%20-%20Mortgage.png)

/Akkuro.com%20-%20Sustainability.png?width=2000&height=1500&name=Akkuro.com%20-%20Sustainability.png)

Purpose-built for every financial segment

View all segments

Architected for the future

Our composable architecture gives you the freedom to assemble, deploy and evolve banking components as your strategy demands. We offers modular, domain-specific building blocks that work together seamlessly through a unified orchestration layer: structuring data, connecting services and powering smarter, faster customer experiences. Every service is API-driven and cloud-native, ensuring interoperability, fast integration and continuous innovation. This means you can evolve incrementally or overhaul entirely.

On your terms.

At your pace.

Creating impact through connections

A platform that grows with you

How can you meet today’s needs - and be ready for what’s next?

Get in touch