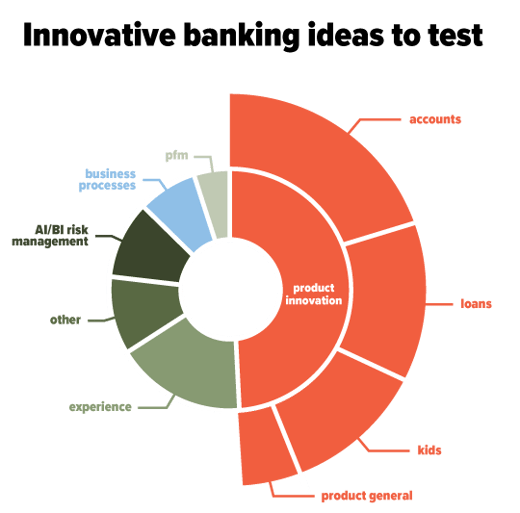

We asked which ideas are currently not being tested because the investment in terms of time, money, and technology is simply too big. Here is a glimpse of what they shared.

The results were surprising. 48% of responses had to do with product innovation. 25% of those ideas had to do with products – account-based products obviously – for kids. Reading the responses there is an apparent drive among banking innovation specialists to develop an accounts solution that will effectively guide children in on their first steps dealing with (digital) money. Various respondents describe teaching children to responsibly deal with money. It will help them to grow into successful individuals, capable of managing their money wisely. No other target audience was mentioned specifically.

When you think about it, it makes sense. The C-level audience involved with banking innovation is likely to have reached that stage of the Maslow pyramid, where they want to leave some sort of legacy. And children are the future. But children as a demographic have relatively little money to spend.

The business case is therefore hard to make. It either lies in introducing the parents of the children to your bank or – a more long-term objective - developing a relationship with the children so they perhaps show some brand loyalty once they have reached a ‘profitable’ age. But the whole agile, growth hacking industry that banking now is, has no room for a business case with a window of at least 15 years.

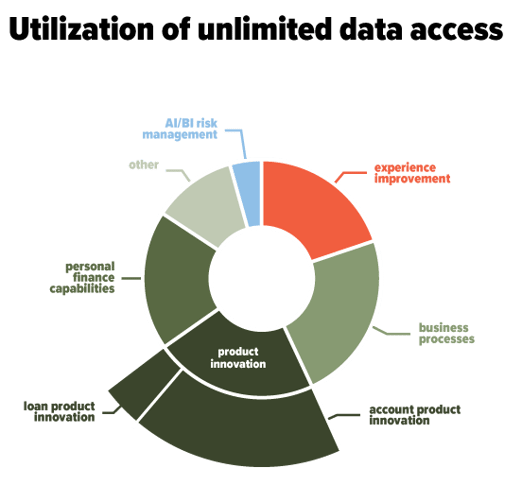

Most striking here is the emphasis on using data to improve business processes and effectiveness. Improving on business processes by cutting costs, optimizing staff, increasing speed and other mostly internal objectives make out almost a quarter of the responses. A very specific category that stood out was the use of data to improve personal financial management capabilities. Most concerned predictive applications of data analysis.

Many banks have tried to offer personal finance management tooling in some form or another but so far very few initiatives have resulted in a sustainable client offering. Nevertheless, judging from the responses to this survey, the ambition of being the keeper of a client’s personal financial wellbeing is not dead yet.

The °neo core banking platform allows you to put new ideas into effect with very little effort and try new initiatives in your personal sandbox. Thanks to data accessibility, you are able to utilize the client and product data in any way you want. During the upcoming months, we will bring you more details of the many ideas our guests shared on how to leverage those capabilities.

If you want to know more about how to realize your ambitions in banking innovation, be sure to contact us for an exploratory meeting. And don’t forget to sign up for our newsletter to stay up to speed on the latest in cloud native banking.

Interested on cloud-native core banking?

Download the guide.